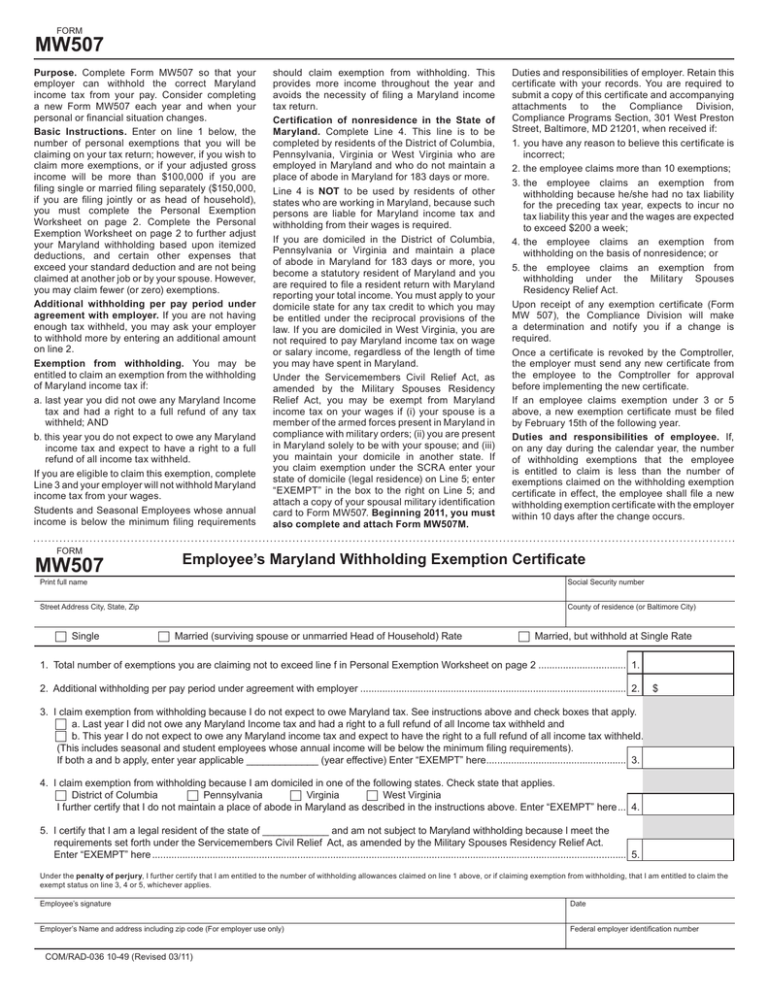

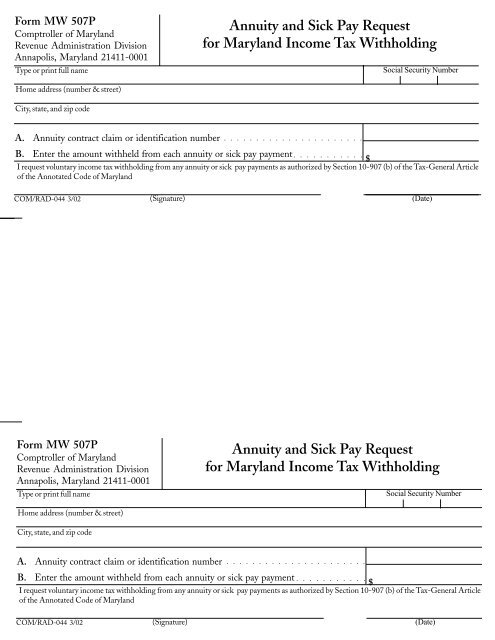

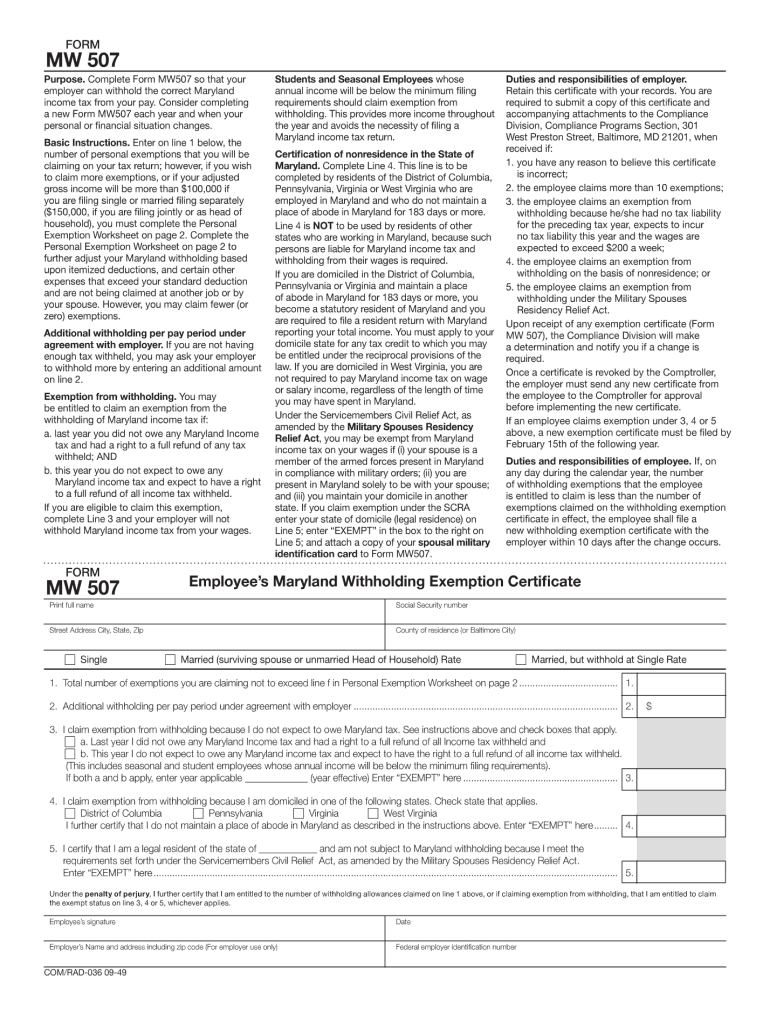

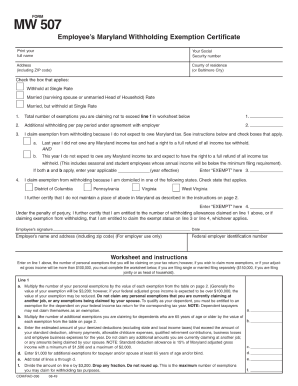

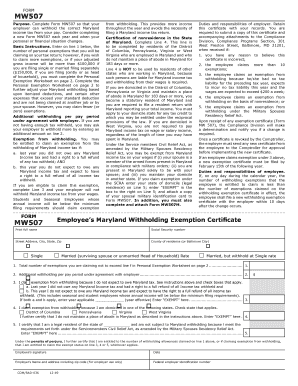

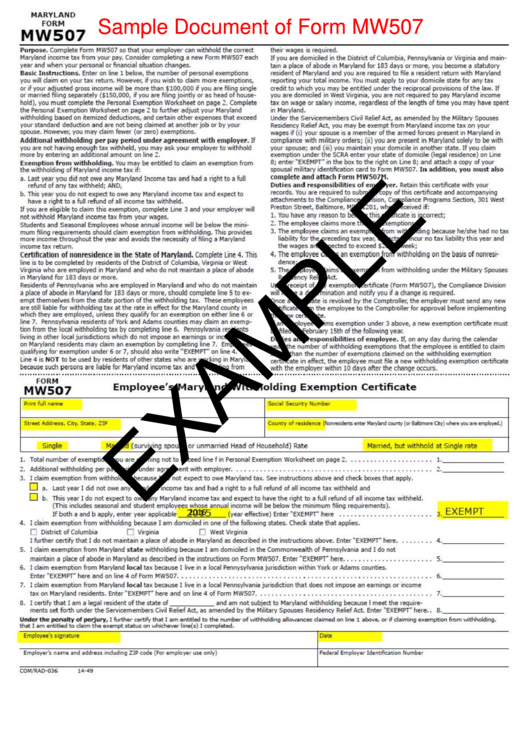

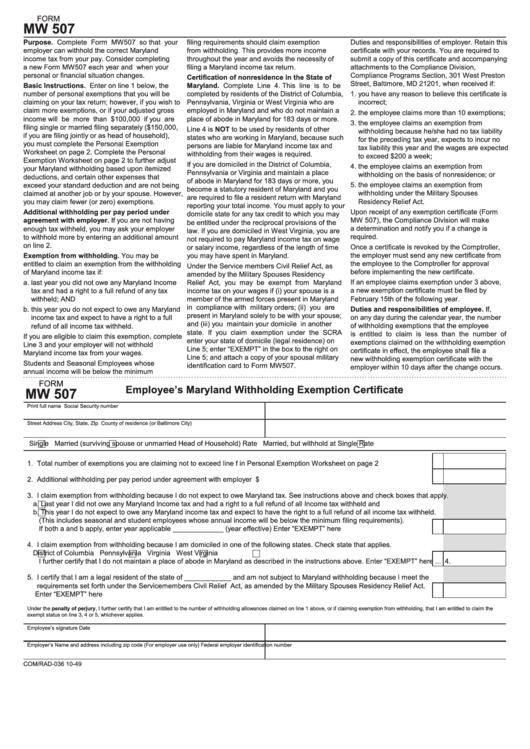

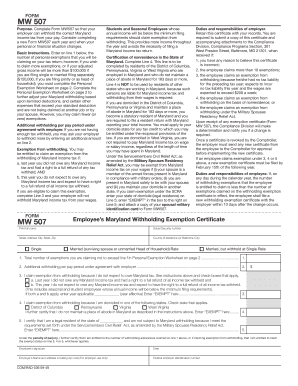

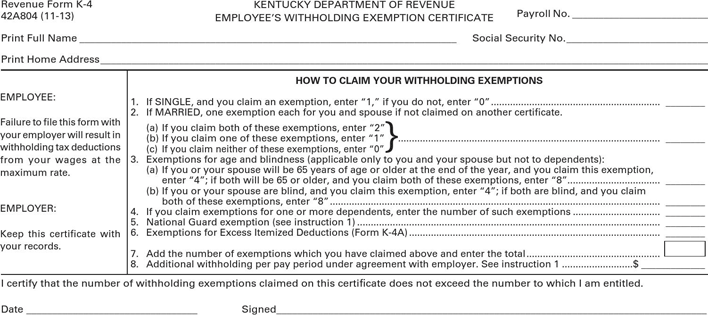

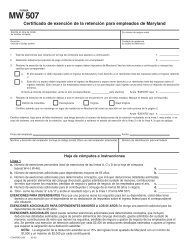

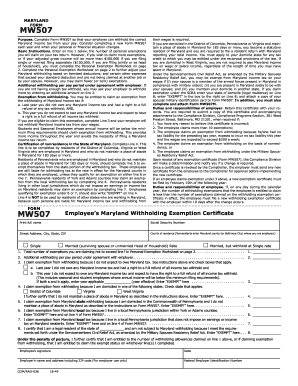

Editable MD Comptroller MW 507 21 Download blank or fill out online in PDF format Complete, sign, print and send your tax documents easily with US Legal FormsFORM COM/RAD036 1949 MW507 Purpose Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay Consider completing a new Form MW507 each year and when your personal or financial situation changes Basic Instructions Enter on line 1 below, the number of personal exemptions you will claim on your tax returnSu primer gol de 21

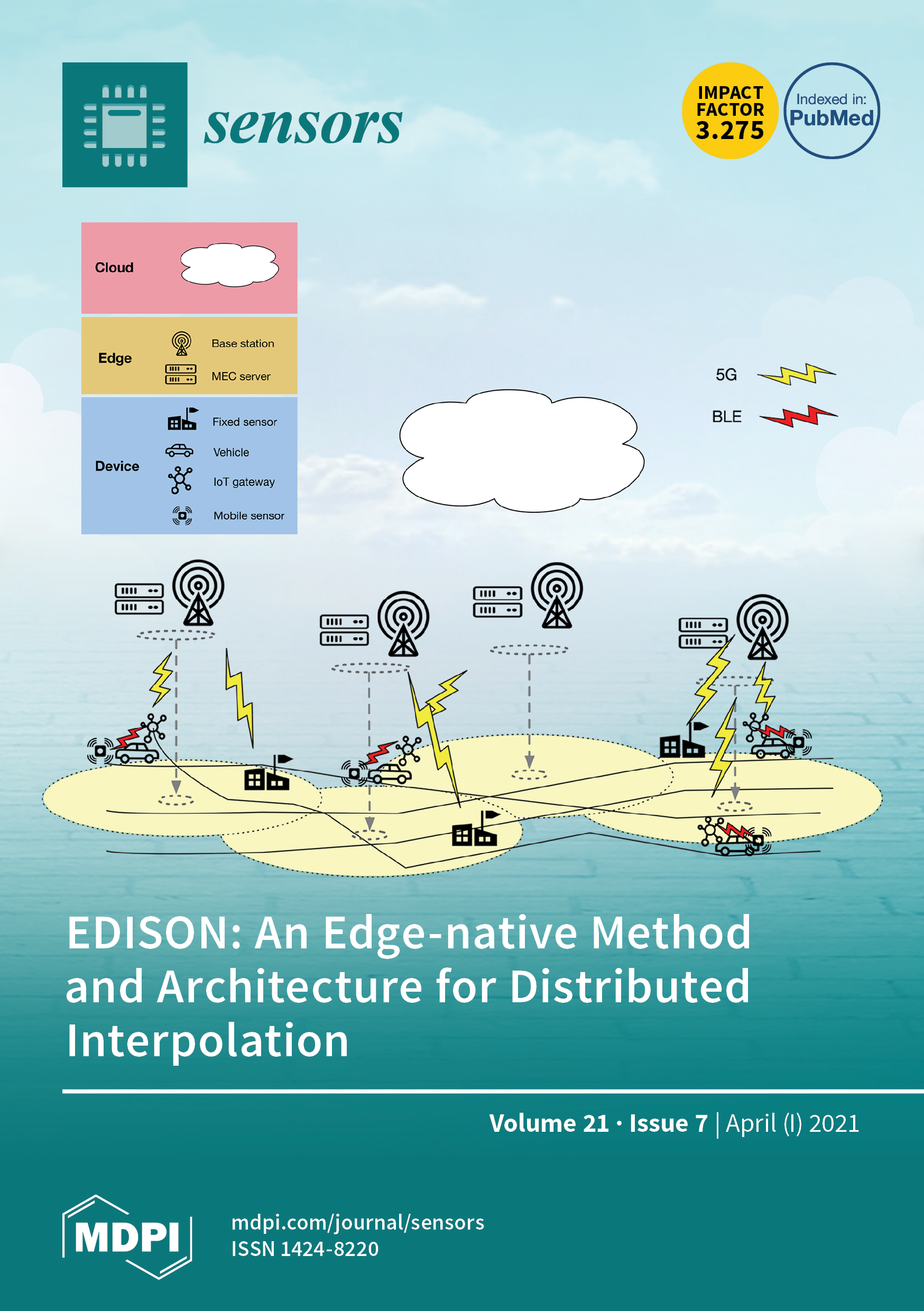

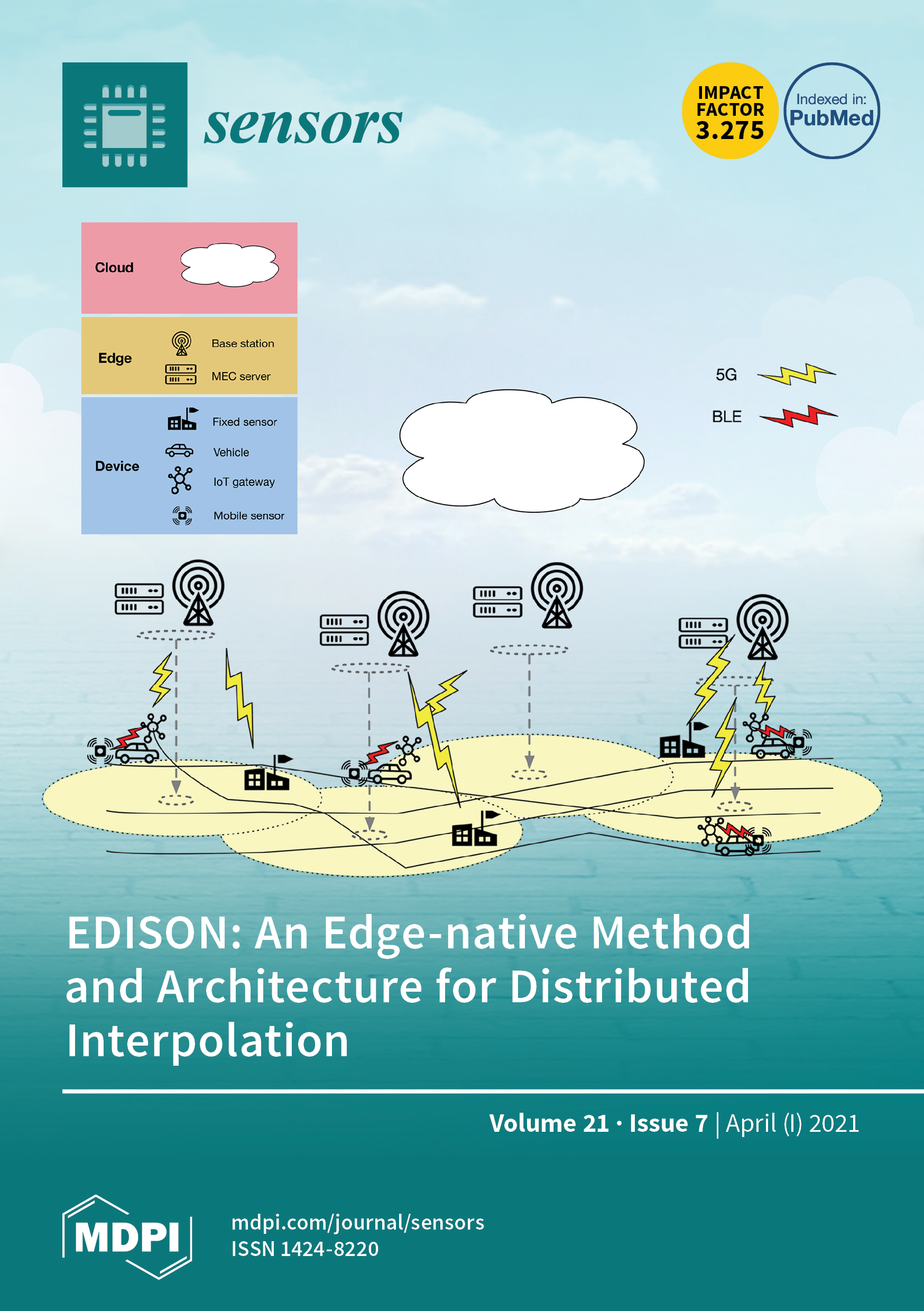

Sensors April 1 21 Browse Articles

Mw 507 form 2021

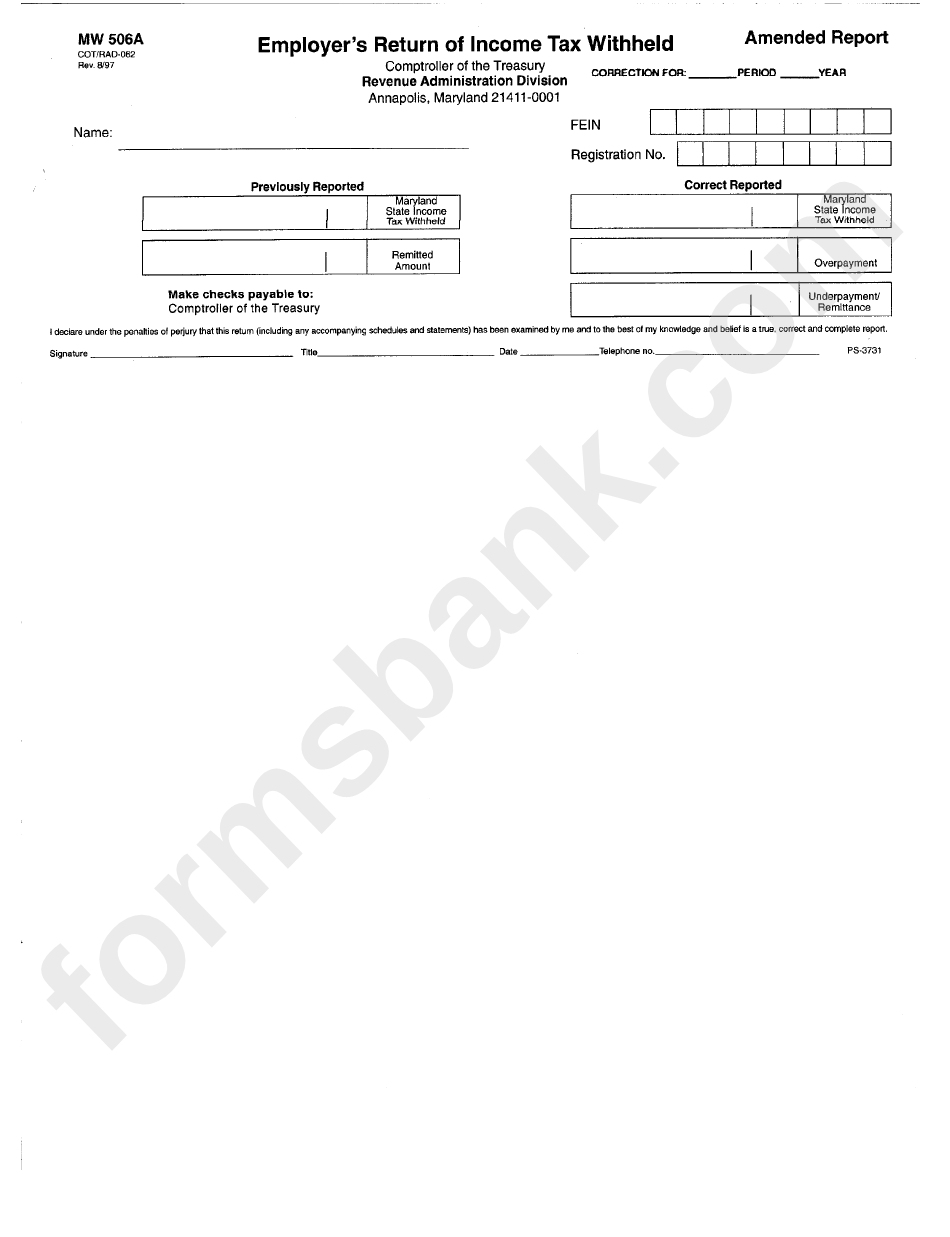

Mw 507 form 2021-Mar 10, 21 The seller's Maryland income tax return for the year of the sale will of Full or Partial Exemption (Maryland Form MW506AE) to the Maryland Maryland State Payroll Taxes Jul 15, 21 Maryland requires employers to withhold state income taxes from Form MW506 , Employer Return of Income Tax Withheld , is filed on anHave no dependents to claim you can enter 1 exemption on line 1 or if you want to force a refund enter a zero

How To Fill Out The Personal Allowances Worksheet W 4 Worksheet For 19 H R Block

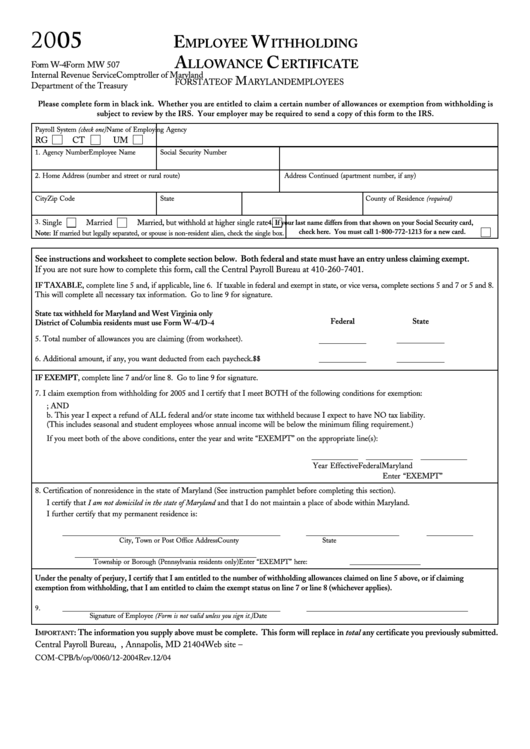

Form W4/MW 507 TU pays every 2 weeks (biweekly) Example A student worker who is single and wrote "1" on line 3 on the W4/MW 507, makes $ in a pay period This earned incomes falls in the $115$1 bracket In the "1" column of the chart below, it says that $9 tax is to be withheld Therefore, a paycheck for about $Withholding Tax Forms for 21 Filing Season (Tax Year ) File the FR900A if you are an annual wage filer whose threshold is less than $0 per year Note The 19 FR900A is due January 31, Deposits are due by January , , for the preceding calendar year File the FR900Q if you are required to pay monthly or quarterlyForm MW507 Employee Withholding Exemption Certificate 21 Comptroller of Maryland FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY Section 1 – Employee Information (Please complete form

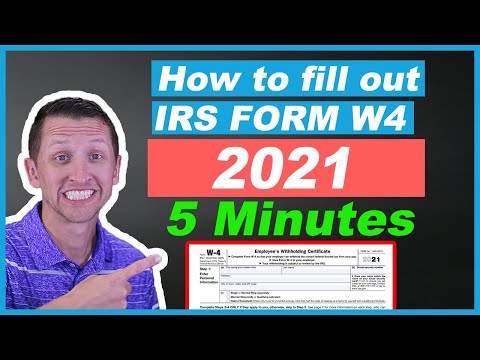

MW 507 MW 507 Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay Consider completing a new Form MW507 each year Individual Withholding Forms Messi marcóTo be accurate, submit a 21 Form W4 for all other jobs If you (or your spouse) have selfemployment income, including as an independent contractor, use the estimator Complete Steps 3–4(b) on Form W4 for only ONE of these jobs Leave11 Form W4 Instructions Page 1 Employee's Federal Withholding Allowance Form W4 (11) Purpose Complete Form W4 so that your employer can

Fill Online, Printable, Fillable, Blank Form MW507 Employee Withholding Exemption Certificate 21 (Comptroller of Maryland) Form Use Fill to complete blank online COMPTROLLER OF MARYLAND (MD) pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadable7 редаApplication for Tentative Refund of Withholding on 21 Sales of Real Property byV any Employee Withholding Exemption Certificate V any

Fill Free Fillable Forms Comptroller Of Maryland

New Employee Payroll Forms Advanced Payroll Solutions

mw507 form help When submitting the Maryland form, you also want to be included in a duplicate of Delaware returns You can save the completed form in your company and update it as needed The W4 module includes a support sheet that will allow you to practice This module collects basic biographical information on candidatesMW 507FORM Employee's Maryland Withholding Exemption Certificate Print your full name Your Social Security number Address (including ZIP code) County of residence (or Baltimore City) Withhold at Single Rate Married (surviving spouse or unmarried Head of Household) Rate Married, but withhold at Single Rate 1Form W4 Basics 21 Edition A new employer should provide you with a blank Form W4 to complete when you start a new job But there may also be times when you'll want to adjust your withholding even on a job you already have It might be necessary if you get married or have a child, since either has the potential to change your tax liability

How To Fill Out Mw507 Form Single And Married Examples Easy Info Blog

Should I Claim 0 Or 1 On W 4 21 W 4 Expert S Answer

MW 507 4716 Just need to explain bioidentical hormones for breast cancer survivors by jeffrey dach md morning rounds with dr steven economou at rush hospital breast cancer surgeon We should take a look 5 refer to appendices b c and j for instructions and format examples of form b3 form b3 bonded warehouse and form b3 consolidated respectivelyInventory Unit Detail Podein's Power Equipment Stewartville, MN (507)• Enter date, print form, sign and submit to Towson University's Payroll Office Instructions for the Maryland Withholding Form MW 507 Step 1 Personal Information • Check appropriate marital status box • Line 1 Enter the total number of allowances you are claiming • Line 2

:max_bytes(150000):strip_icc()/Screenshot19-f74986306e004d1ca1a01e39b79a3cf1.png)

What Is Form W 4

European Resuscitation Council Guidelines 21 Paediatric Life Support Resuscitation

Search for Forms A list of forms for current and future Project CHANGE Maryland members We ask you to spend an appropriate amount of time filling each one in and if you should need any assistance, please feel free to get in contact Form MW 507;Created Date 12/31/19 AMI'm an international student at University of Maryland, I just got a 10hour/week graduate assistantship at our school For the 21 MW507 Form, section 2, what's the difference between putting 0 or 1 read more

Mw507

Derby Arona The Rolls Royce Of The Pigeon One Loft Races

May 01, 21 Deciding When to Use A 1099 Instead of W2 Apr , 21 A Guide to the Types of 1099 Form 18 Apr 15, 21 How to Find the Best Restaurant Payroll Software Apr 09, 21 ADDRESS Advanced Micro Solutions, IncWe last updated Maryland MW507P in April from the Maryland Comptroller of Maryland This form is for income earned in tax year , with tax returns due in April 21 We will update this page with a new version of the form for 22 as soon as it is made available by the MarylandForms and Publications (PDF) Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms

Spartan Acquisition Corp Ii Merger Prospectus Communication 425

State W 4 Form Detailed Withholding Forms By State Chart

Inventory Unit Detail Podein's Power Equipment Stewartville, MN (507)Form MW507 Form MW508 Recent Posts A Guide to the Most Used 1099s 19 What Will the Most Used 1099 Forms Be?We last updated Maryland MW507 in February 21 from the Maryland Comptroller of Maryland This form is for income earned in tax year , with tax returns due in April 21 We will update this page with a new version of the form for 22 as soon as

Mw507 Copy Copy Com Rad 036 09 49 Form Mw 507 Purpose Complete Form Mw507 So That Your Employer Can Withhold The Correct Maryland Income Tax From Course Hero

Mw 507 Fill Out And Sign Printable Pdf Template Signnow

MD tax witholding form;Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay Consider completing a new Form MW507 each year and when your personal or financial situation changes Basic Instructions Enter on line 1 below, the number of personal exemptions you will claim on your tax returnYW Securityplus Account 21 Date01//21 Description Download YW!

M W 5 0 7 F O R M 2 0 2 1 Zonealarm Results

Should I Claim 0 Or 1 On W 4 21 W 4 Expert S Answer

Form W4 (21) Page 3 Step 2(b)—Multiple Jobs Worksheet (Keep for your records) If you choose the option in Step 2(b) on Form W4, complete this worksheet (which calculates the total extra tax for all jobs) on only ONE Form W4 Withholding will be most accurate if you complete the worksheet and enter the result on the Form W4 for theWe last updated the Employee's Maryland Withholding Exemption Certificate in February 21, so this is the latest version of MW507, fully updated for tax year You can download or print current or pastyear PDFs of MW507 directly from TaxFormFinder You can print other Maryland tax forms here Related Maryland Individual Income Tax FormsReady Curriculum Date Description A youth professional development curriculum for YouthWorks Worksites This activitybased curriculum is a tool for worksite supervisors to provide instruction to YouthWorkers on job readiness skills

Prepare And Efile A 21 Maryland State Income Tax Return

Towson University Cannot Legally Tell You How To Complete Form W4 Ppt Download

I am filling out the MW 507 form and need some help I am filing single but don't know what to put for exemptions If you are single &MW507M — Exemption from Maryland Withholding Tax for a Qualified Civilian Spouse of a U S Armed Forces Servicemember Type Exempt military spouseMW 507 — Employee's Maryland Withholding Exemption Certificate Type Resident;

Republic Of South Africa 19 Annual Report For Foreign Governments 18 K

Payroll Forms Washington D C Welcome To Human Resources Cua

The Talbot County Board of Education is committed to promoting the worth and dignity of all individuals The Board will not tolerate or condone any act of bias, discrimination, insensitivity, or disrespect toward any person on the basis of race, color, sex, gender, gender identity, sexual orientation, age, national origin, religion, socioeconomic status or disabling conditionComplete Mw507 21 online with US Legal Forms Easily fill out PDF blank, edit, and sign them Save or instantly send your ready documentsATTN MDNGAGARCHIVES (Mr Gary) 5th Regiment Armory 29th Division Street Baltimore, MD Individual Request Form Use this form if you are the service member requesting a copy of your own service records of time served in the Maryland Army/Air National Guard Relative Request Form Use this form if you are a family member

Esc Guidance For The Diagnosis And Management Of Cv Disease During The Covid 19 Pandemic

Fill Free Fillable Forms Comptroller Of Maryland

The Maryland Form MW 507 is the Employee's Maryland Withholding Exemption Certificate The MW507 form must be completed so that you know how much state income tax to withhold from your new employee's wagesRecruiting 2122 Team 21;MW 507 MW 507 Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay Consider completing a new Form MW507 each year 21 Form MD Comptroller MW506AE Fill Online, Printable, Fillable Form MW506AE;

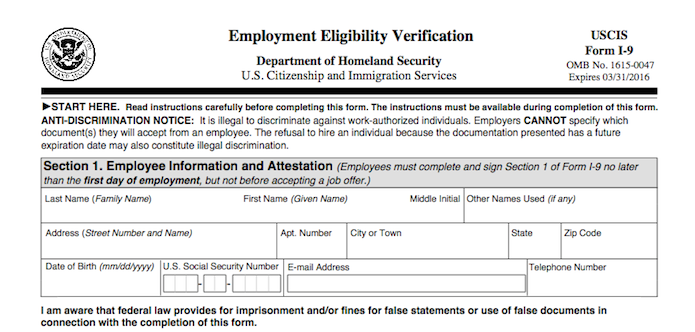

Workplace Basics Completing I 9 And W 4 Forms

Annuity And Sick Pay Request For Maryland Income Tax Withholding

How to fill out a W4 Form is a video covering the new tax form that determines how much taxes you should be withholding from your paycheck We will walk youForm Mw 507 1021 Under the SCRA enter your state of domicile legal residence on Line 8 enter EXEMPT in the box to the right on Line 8 and attach a copy of your spousal military identiication card to Form MW507 In addition you must also complete and attach Form MW507M Duties and responsibilities of employerMW 507 Keywords Form MW507;

Md Comptroller Mw 507 09 Fill Out Tax Template Online Us Legal Forms

Bill Of Sale Form Maryland Form Mw 507 Templates Fillable Printable Samples For Pdf Word Pdffiller

The Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wagesThe importance of having each employee file a state withholding certificate as well as a federal Form W4 cannot be overstated, so make its completion a priorityMw 507 Form 1521 Separately ($150,000, if you are filing jointly or as head of household), you must complete the Personal Exemption Worksheet on page 2 Complete the Personal Exemption Worksheet on page 2 to further adjust your Maryland withholding based on itemized deductions, and certain other expenses that exceed your standard deductionFind a Form Tax Year Category Form Type Form Tax Year Description Filing Options;

VSKP.jpg)

Cda Secunderabad View All Uploads

Ecological Opportunity And The Rise And Fall Of Crocodylomorph Evolutionary Innovation Proceedings Of The Royal Society B Biological Sciences

Fill Online, Printable, Fillable, Blank Form 21 MW507M for a Qualied Civilian Spouse (Comptroller of Maryland) Form Use Fill to complete blank online COMPTROLLER OF MARYLAND (MD) pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadableYou can learn quite a bit about the state's withholding form requirements and still not stumble upon one of the very first forms you'll need to set up your Maryland payroll Form MW507 This is the worksheet form that your employee will need to fill out so that you can calculate the estimated income tax to withhold from the employee's paycheck based on their personal exemptionsIndividual Tax Forms 19 Individual Tax Forms Business Forms 19 Business Income Tax Forms POPULAR What's New This Tax Year Individual Tax

Md Comptroller Mw 507 21 Fill Out Tax Template Online Us Legal Forms

Maryland Tax And Labor Law Summary Care Com Homepay

Form MW507 Employee Withholding Exemption Certificate Comptroller o r Maryland FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY Section 1 – Employee Information (Please complete form in black ink) Payroll System (check one) RG CT UM Name of Employing Agency Agency Number Social Security Number Employee Name

Sustainability April 1 21 Browse Articles

Fill Free Fillable Forms Comptroller Of Maryland

Md Comptroller Mw506ae 21 Fill Out Tax Template Online Us Legal Forms

Federal And State W 4 Rules

State W 4 Form Detailed Withholding Forms By State Chart

Benefits Forms Washington County

Fill Free Fillable Forms Comptroller Of Maryland

11 Form Md Comptroller Mw 507 Fill Online Printable Fillable Blank Pdffiller

Mw507 Tutorial Fill Out And Sign Printable Pdf Template Signnow

Sensors April 1 21 Browse Articles

Reciprocal Agreements By State What Is Tax Reciprocity

How To Fill Out Maryland Mw507 Form

Taxhow Maryland Tax Forms 19

Form Mw 506a Employer S Return Of Income Tax Withheld Form Comptroller Of The Treasury Annapolis Maryland Printable Pdf Download

Esc Guidance For The Diagnosis And Management Of Cv Disease During The Covid 19 Pandemic

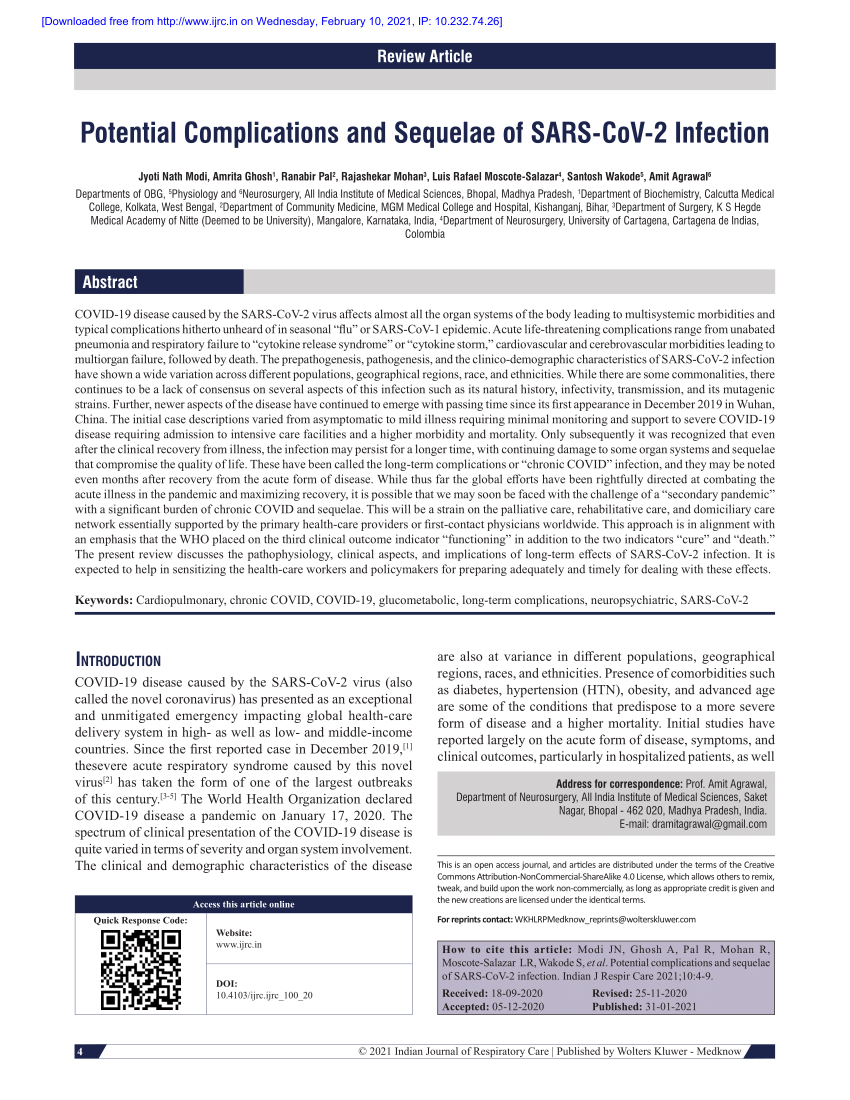

Pdf Potential Complications And Sequelae Of Sars Cov 2 Infection

M W 5 0 7 F O R M 2 0 2 1 Zonealarm Results

Printable Maryland Income Tax Forms For Tax Year

European Resuscitation Council Guidelines 21 Ethics Of Resuscitation And End Of Life Decisions Resuscitation

No Idea How To Fill Out Mw 507 Fill Online Printable Fillable Blank Pdffiller

Top 6 Mw507 Form Templates Free To Download In Pdf Format

Fill Free Fillable Forms Comptroller Of Maryland

Fill Free Fillable Forms Comptroller Of Maryland

M A R Y L A N D S T A T E T A X W I T H H O L D I N G F O R M Zonealarm Results

How To Fill Out Irs Form W4 21 Fast Youtube

M W 5 0 7 F O R M 2 0 2 1 Zonealarm Results

Top 6 Mw507 Form Templates Free To Download In Pdf Format

How To Fill Out W4 Single Filers Youtube

European Resuscitation Council And European Society Of Intensive Care Medicine Guidelines 21 Post Resuscitation Care Resuscitation

Mw507 Example Fill Online Printable Fillable Blank Pdffiller

International Market Research Day 21 Esomar The Global Insights Community

Sage State Tax Form Mw507 Youtube

State Tax Withholding Forms Template Free Download Speedy Template

Maryland Nanny Tax Rules Poppins Payroll

Taxhow Maryland Tax Forms 19

Pdf Major Volcanic Eruptions Linked To The Late Ordovician Mass Extinction Evidence From Mercury Enrichment And Hg Isotopes

Groundwater Depletion Clouds Yemen S Solar Revolution

Youth

Tax And W 2 Information

How To Fill Out The Personal Allowances Worksheet W 4 Worksheet For 19 H R Block

Annuity And Sick Pay Request For Maryland Income Tax Withholding

Youth

How To Fill Out Irs Form W4 21 Fast Youtube

U S Citizens And Residents Forms And Publications Tax Department Finance Division The George Washington University

Maryland Payroll Services Adp

Packaging World January 21 By Pmmimediagroup Issuu

Maryland Payroll Services Adp

State Tax Withholding Certificates For Production Crew Media Services

Payroll Forms Washington D C Welcome To Human Resources Cua

21 Federal State Payroll Tax Rates For Employers

Tubor Mfsa

Top 6 Mw507 Form Templates Free To Download In Pdf Format

Benefits Forms Washington County

Mw507 Fill Out And Sign Printable Pdf Template Signnow

State Withholding Exemption Forms Extreme Reach Payroll Solutions

21 Federal State Payroll Tax Rates For Employers

Federal And State W 4 Rules

0 件のコメント:

コメントを投稿